Page 16 - PAFR 2023

P. 16

The City Revenues and Expenses

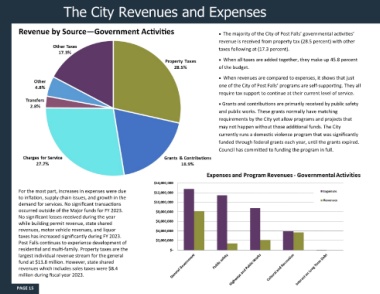

Revenue by Source—Government Activities • The majority of the City of Post Falls’ governmental activities’

revenue is received from property tax (28.5 percent) with other

taxes following at (17.3 percent).

• When all taxes are added together, they make up 45.8 percent

of the budget.

• When revenues are compared to expenses, it shows that just

one of the City of Post Falls’ programs are self-supporting. They all

require tax support to continue at their current level of service.

• Grants and contributions are primarily received by public safety

and public works. These grants normally have matching

requirements by the City yet allow programs and projects that

may not happen without those additional funds. The City

currently runs a domestic violence program that was significantly

funded through federal grants each year, until the grants expired.

Council has committed to funding the program in full.

For the most part, increases in expenses were due

to inflation, supply chain issues, and growth in the

demand for services. No significant transactions

occurred outside of the Major funds for FY 2023.

No significant losses received during the year

while building permit revenue, state shared

revenues, motor vehicle revenues, and liquor

taxes has increased significantly during FY 2023.

Post Falls continues to experience development of

residential and multi-family. Property taxes are the

largest individual revenue stream for the general

fund at $13.8 million. However, state shared

revenues which includes sales taxes were $8.4

million during fiscal year 2023.

PAGE 15